tax avoidance vs tax evasion hmrc

Tax evasionThe failure to pay or a deliberate underpayment of taxes. Tax evasion is a criminal act which perpetrators can face prosecution for it while tax avoidance can be seen as using the loopholes in.

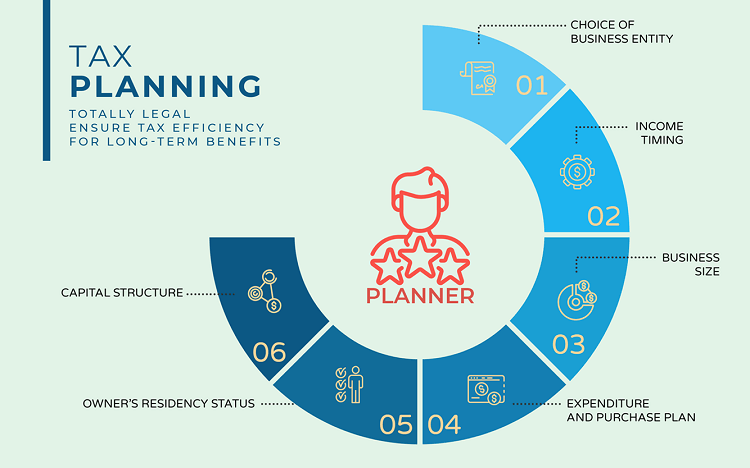

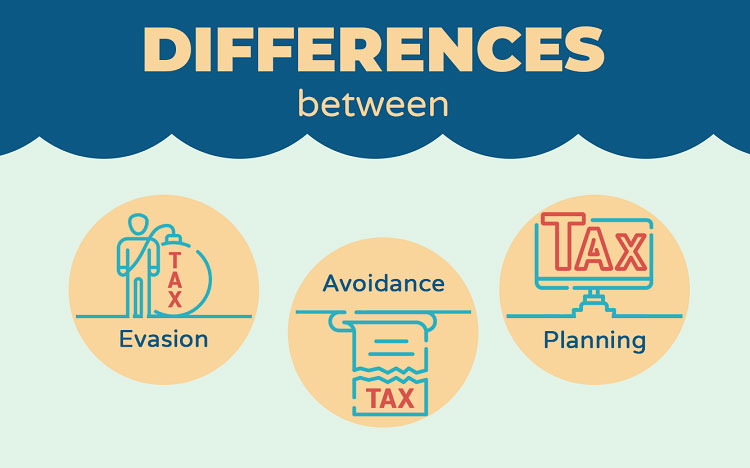

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Well taxation has been receiving much attention and this means that the debate has been an.

. Tax evasion means concealing income or information from the HMRC and its illegal. Report someone to HM Revenue and Customs HMRC if you think theyre evading tax. Dont try to find out more about the tax evasion or let anyone know youre making a.

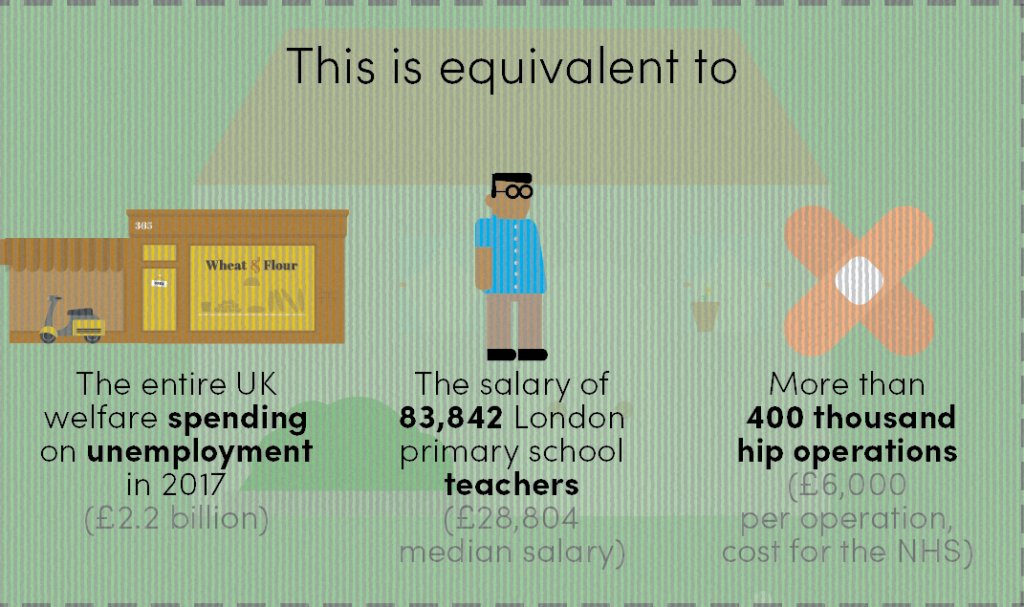

How does this work. HMRC estimates that 27 billion was lost through tax avoidance and 44 billion through tax evasion in 201314. Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments.

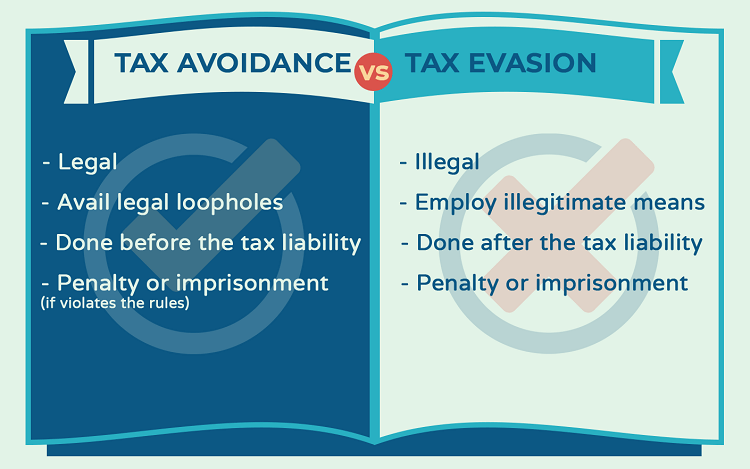

Definitions and Differences Tax evasion means concealing income or information from tax authorities and its illegal. Tax evasion means doing illegal things to avoid paying taxes. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe.

Its because theres a difference between tax avoidance and tax evasion. There is a fine line between avoidance and evasion. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion.

It is split into three chapters and outlines HMRCs. One is illegal the other is legal though arguably immoral when done on a larger scale. And as best I can tell it remains the case that tax avoidance is not illegal.

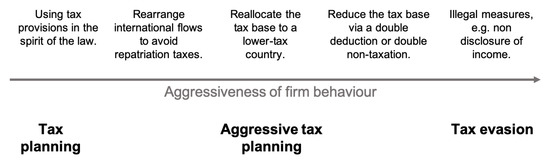

Underground economyMoney-making activities that. The Taxpayers Responsibilities Key Terms tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Within recent time however there are cases where avoidance is declared as illegal.

While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to lower the obligations of. Its the Al Capone path to financial freedom. This is wrong according to the estimates its using.

Tax avoidance involves bending the rules of the tax system to gain a tax advantage that Parliament never intended. Evasion and avoidance in th. Key Differences Between Tax Evasion vs Tax Avoidance.

Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. My understanding is that tax avoidance refers to legal methods of reducing a tax liability whereas tax evasion refers to illegal methods. TAX EVASION TAX AVOIDANCE The term tax evasion summarizes any action taken to avoid or reduce tax by illegal means.

This policy paper sets out the governments approach and achievements in tackling tax avoidance evasion and other forms of non-compliance. 34 billion is the total value of tax that goes uncollected. For instance claiming expenses for your work uniform is tax avoidance and is perfectly legal.

Tax avoidance is the reduction of a tax bill through legal means whilst tax evasion is the non-payment of tax that is legally due. Your Role as a Taxpayer Lesson 3. Its not always easy to see where one ends and the other begins.

Tax avoidance is using the taxation regime to ones own. Tax evasion and tax avoidance costs the government 34 billion a year. Tax avoidance is often defined in opposition to tax evasion with tax evasion being illegal and tax avoidance being legal.

Tax Evasion Understatingconcealing income or overstatingfabricating expenses would be classed as tax evasion. Tax avoidance means legally reducing your. Many tax avoidance schemes devised by accountants and marketed towards the wealthy have been heavily criticised leading to HM Revenue Customs HMRC shutting them down arguing that they amount to tax evasion.

This preview shows page 1 out of 1 page. In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. The HMRC looses an estimated sum of 40 billion annually through tax evasion and avoidance.

Tax avoidance involves using whatever legal means you choose to reduce your current or future tax liabilities. The amount of tax lost in Britain through non-payment avoidance and fraud has increased to 35bn according to official figures. Most people avoid taxes in some way or another.

Heavy Tax Avoidance Offshore corporations and specifically designed tax avoidance schemes would usually fall into this category. Tax evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas tax avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country. The HMRC definition is similar in this regard making reference to the spirit of the law.

Tax avoidance versus tax evasion The difference between tax avoidance and evasion is important due to the legal implications. HMRC have confirmed that they have secured billions of pounds in additional tax revenue over recent years. There is tax avoidance or tax planning which is completely legal.

Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1. Tax Evasion vs. But tax evasion is illegal.

HM Revenue and Customs said the. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. Let us discuss some of the major differences between Tax Evasion vs Tax Avoidance.

James Melville Pa Twitter We Lose 120 Billion In Tax Avoidance And Tax Evasion That S Enough To Give The Nhs 2 Billion A Week Put That On The Side Of A Bus

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

John Wade On Twitter Read It And Weep Social Awareness Graphing

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

What Is Tax Evasion The Motley Fool

How Much Does Tax Avoidance Cost

Differences Between Tax Evasion Tax Avoidance And Tax Planning

What Is Tax Evasion Definition And Meaning Market Business News

Multinationals Avoid Up To 5 8bn In Uk Tax Hmrc Finds Financial Times

Top 5 Tax Scandals World Finance

/GettyImages-641141038-635672bd575846b5bfcb889f7665134e.jpg)